Single-click Crypto Tax Calculator

Worried about your crypto tax reports? Let CRPTM handle it all.

Streamline your tax process with our cryptocurrency tax calculator. One-click is all it takes to accurately calculate and generate your tax reports. More crypto investments. Fewer taxation worries

What do we offer?

Crypto tax calculator

The easiest and most simplified way to calculate crypto taxes.

Error reconciliation

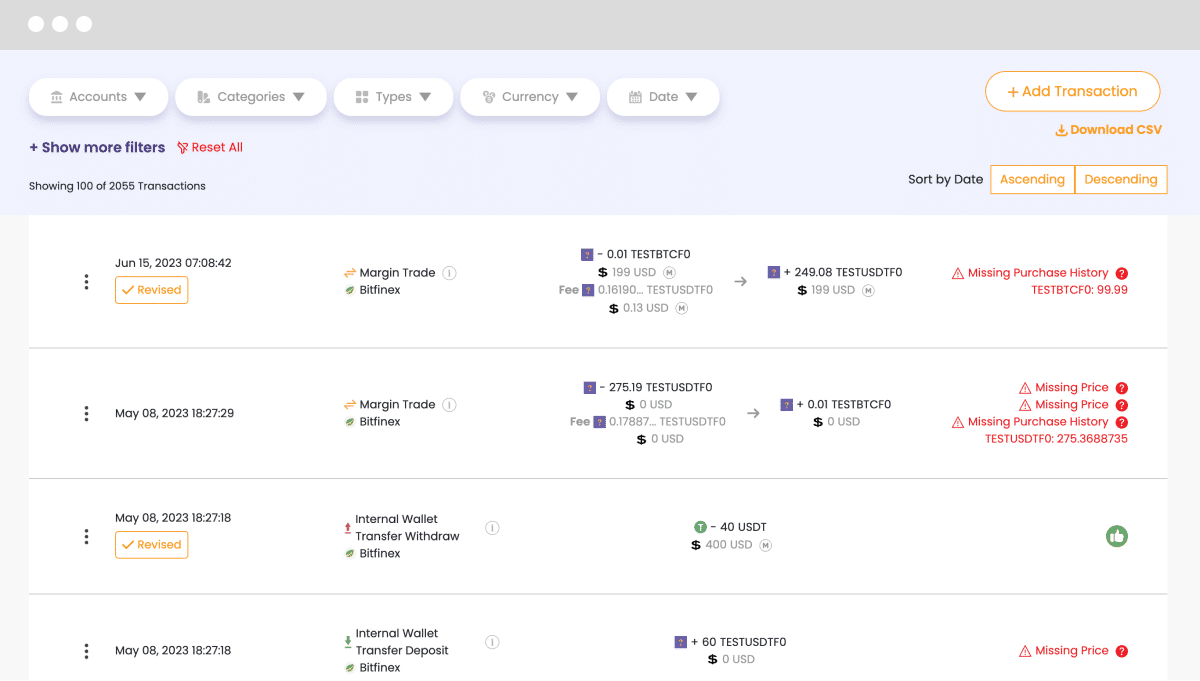

CRPTM helps you reconcile crypto tax calculations and reports

Record transactions

Recording transactions becomes unsettling as the number of transactions increases. You don't have to worry about it anymore.

Free data import

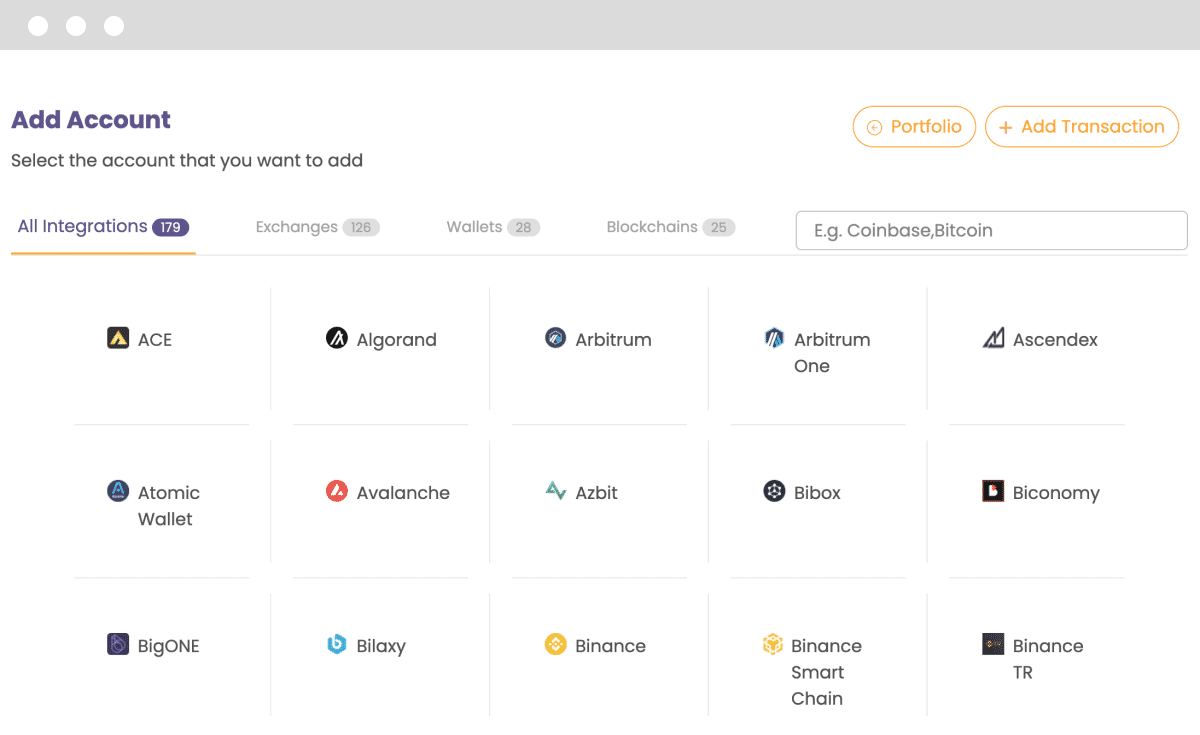

CRPTM lets you import data for free via APIs, CSV files, or manual entries.

Free report preview

With CRPTM, you can track and preview your tax liability and reports for free.

Analyze taxes / Validate tax calculations

Don't just analyze and validate crypto tax calculations. Get more done with CRPTM!

Not just a solution - You get an Experience

A reliable and accurate crypto tax calculation software. Never overpay

How does it work?

A secure and future-ready cryptocurrency tax report generator

Connect to your wallets & crypto exchanges

Review your transactions

Generate your tax reports

Download your tax reports

Your ultimate Crypto tax report generator

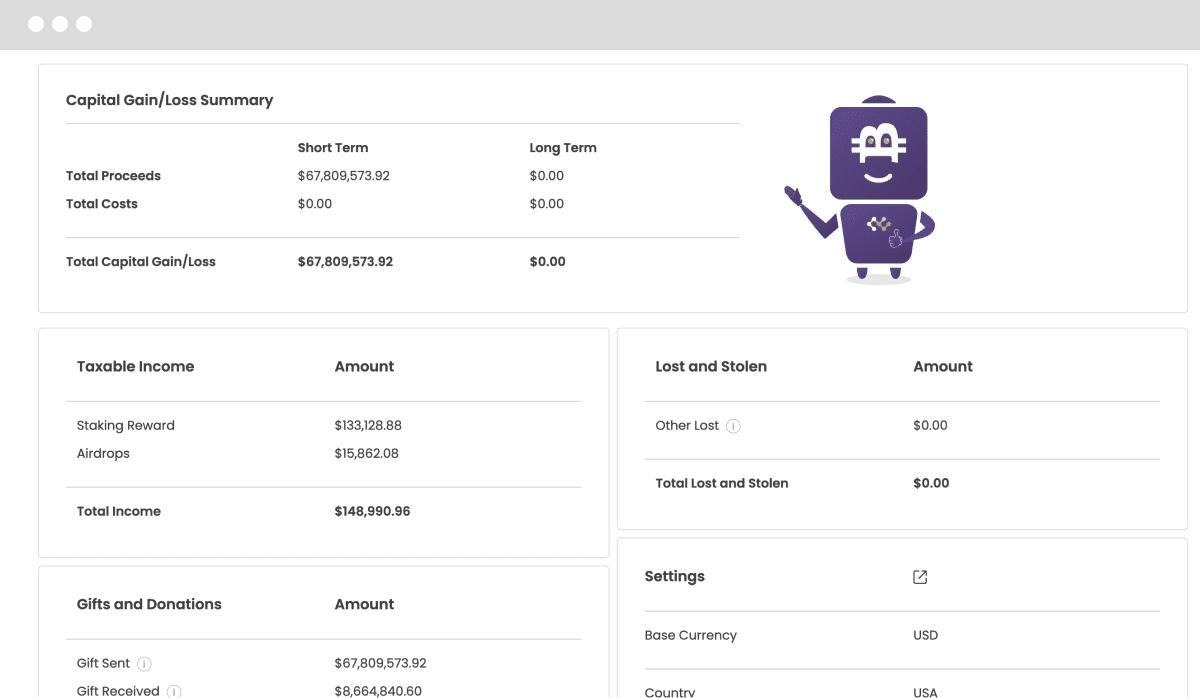

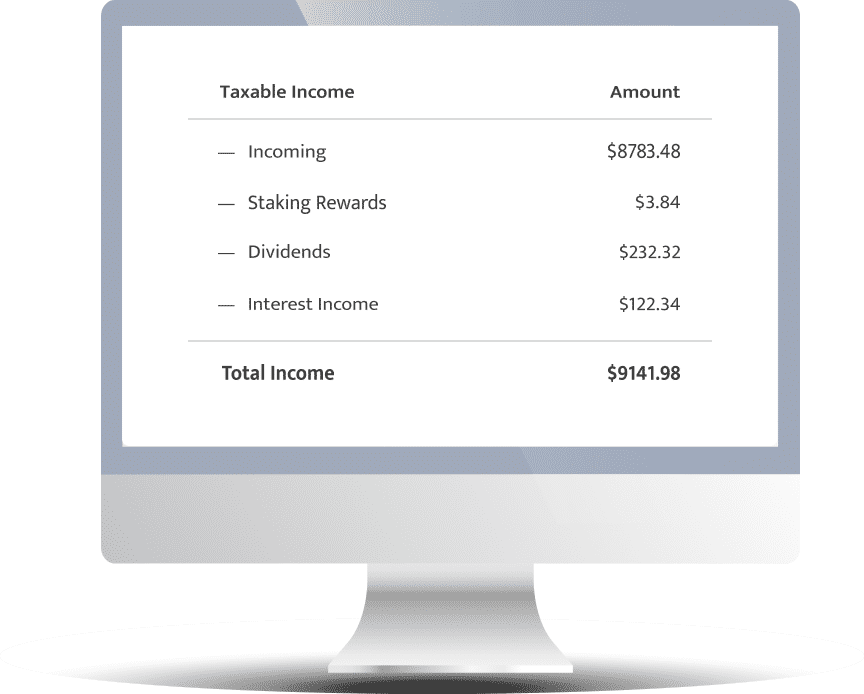

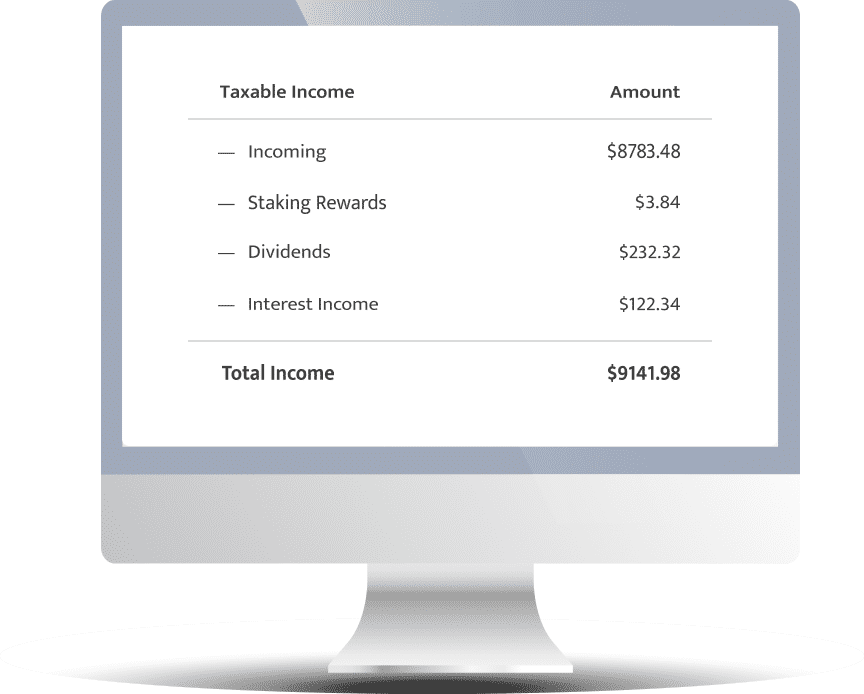

Income reports

See how much you have earned with income reports on CRPTM

Capital gains reports

Get a glimpse of how much you have earned or lost in capital gains

Audit trail reports

CRPTM enables you to generate a complete record of all crypto transactions you have entered on the software

FAQs

You have to pay tax on the difference between the selling price and the price you bought it for (minus any exchange fees) when you sell or trade crypto. It is referred to as a capital gains tax in most countries, such as the USA, UK, Canada, and others.

Yes. Regardless of whether you made gains or losses, you still have to report it to your tax agency. It is in your best interest to report your losses since it is one of the best methods for reducing your crypto taxes.

Yes. Any exchange of cryptocurrencies is also a taxable event.

The same way as regular income.

Crypto taxes are quite difficult to avoid. Every time you transfer funds to an exchange you are leaving a paper trail that tax agencies can use to track those transfers.

No, you don't. As long as you own both wallets, you don’t have to pay taxes on wallet transfers. However, you still have to keep track of the original cost of the transferred coins. Moreover, you should have sufficient proof of it.

CRPTM automatically imports your transactions, finds all the market prices at the time of your trades, matches transfers between your own wallets, calculates your crypto gains or losses, and generates your tax reports.

Hate Crypto Taxation? You’ll love us!

A streamlined process to get your crypto taxes and reports in order, with premium round-the-clock support